Exploring the Possibility: Estate Ownership of a Sole Proprietorship

Have you ever wondered if an estate can hold a sole proprietorship business? The short answer is yes, it is indeed possible. In this article, we will delve deeper into this intriguing question and explore the ins and outs of estate ownership of a sole proprietorship.

First and foremost, it is important to understand what exactly constitutes an estate. An estate refers to all the assets and liabilities left behind by a deceased individual. This can include property, investments, businesses, and other valuable possessions. When a person passes away, their estate is typically managed and distributed according to their will or by the laws of intestacy if there is no will in place.

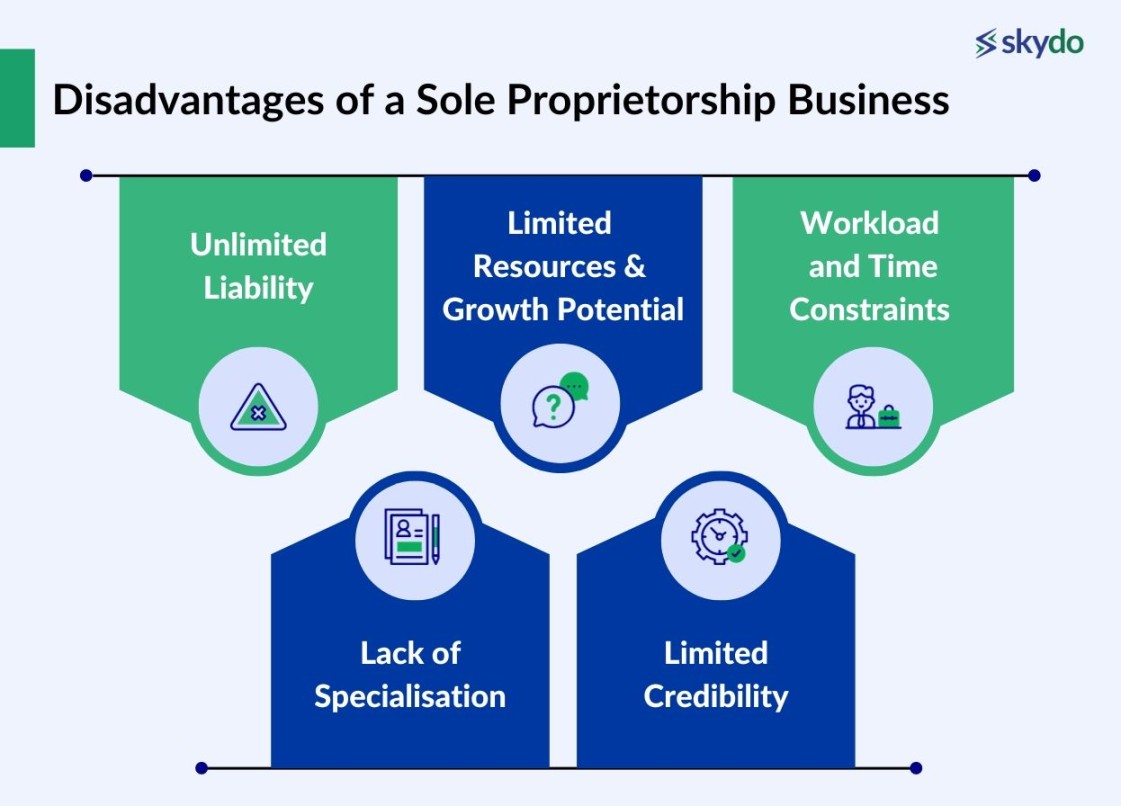

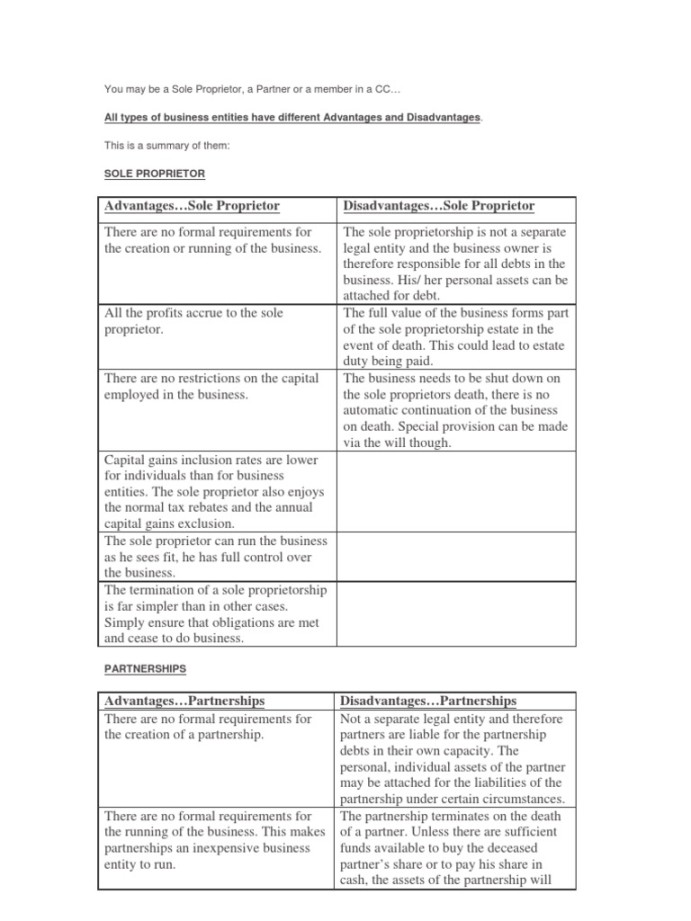

Now, let’s shift our focus to sole proprietorship. A sole proprietorship is a type of business that is owned and operated by one person. It is the simplest form of business organization and does not require any formal legal structure or registration. The owner of a sole proprietorship is personally responsible for all aspects of the business, including its debts and liabilities.

So, how do these two concepts come together? Can an estate actually own a sole proprietorship business? The answer lies in the ability of the executor or personal representative of the deceased individual’s estate to continue operating the business on behalf of the estate.

Image Source: amazonaws.com

In many cases, when a sole proprietor passes away, their business assets become part of their estate. The executor or personal representative of the estate then has the authority to manage and oversee the business operations. This can include continuing to run the business, selling the business assets, or winding down the business if necessary.

One of the key considerations in this situation is ensuring that the estate is able to fulfill any obligations or debts of the business. This may involve working closely with creditors, customers, and other stakeholders to ensure a smooth transition and resolution of any outstanding issues.

Additionally, the executor or personal representative must also consider the tax implications of owning a sole proprietorship business as part of the estate. This may involve filing taxes on behalf of the business and ensuring compliance with all relevant tax laws and regulations.

Despite the potential challenges, there are also opportunities that come with estate ownership of a sole proprietorship. For example, the business may have valuable assets, intellectual property, or a loyal customer base that can be leveraged for financial gain. By carefully managing the business operations, the executor or personal representative may be able to maximize the value of the business for the benefit of the estate and its beneficiaries.

In conclusion, while it may seem unconventional, an estate can indeed hold a sole proprietorship business. By understanding the legal implications, tax considerations, and potential opportunities, the executor or personal representative of the estate can navigate this unique situation with confidence and skill. Ultimately, estate ownership of a sole proprietorship can be a challenging yet rewarding endeavor for those willing to take on the task.

Can an Estate Hold a Sole Proprietorship Business?

Unlocking the Potential: Turning an Estate into a Business Owner

Image Source: scribdassets.com

When it comes to estate planning, many people focus on passing down their assets to their loved ones. However, what if instead of simply transferring wealth, an estate could actually become a business owner in its own right? This idea may sound unconventional, but with the right planning and strategy, it is entirely possible to unlock the potential of an estate and turn it into a sole proprietorship business.

The concept of an estate owning a business may seem strange at first, but it actually makes a lot of sense when you consider the benefits it can offer. By setting up a sole proprietorship under the ownership of an estate, you can ensure that the business continues to operate and generate income even after the original owner has passed away. This can provide financial security for your heirs and ensure that your legacy lives on through the success of the business.

One of the key advantages of turning an estate into a business owner is the potential for tax savings. By structuring the business in this way, you may be able to take advantage of certain tax benefits that are available to businesses, such as deductions for business expenses and the ability to pass on assets to heirs at a lower tax rate. This can help to maximize the value of the estate and ensure that more of your hard-earned money stays within your family.

In addition to the financial benefits, turning an estate into a business owner can also provide a sense of continuity and purpose for your heirs. By creating a business that is owned by the estate, you are giving your loved ones the opportunity to continue your legacy and build something meaningful for themselves. This can be especially important for families who have a long history of entrepreneurship or who have a special connection to a particular business or industry.

Of course, setting up an estate as a business owner is not without its challenges. It is important to carefully consider the legal and logistical aspects of this arrangement, including how the business will be managed and who will have authority to make decisions on behalf of the estate. It may also be necessary to consult with a financial advisor or estate planner to ensure that the business is structured in a way that maximizes its potential for success.

Despite these challenges, the potential rewards of turning an estate into a business owner are well worth the effort. Not only can this arrangement provide financial security and tax benefits for your heirs, but it can also create a lasting legacy that continues to grow and thrive for generations to come. By thinking creatively and exploring new possibilities for estate planning, you can unlock the potential of your estate and ensure that your hard work and dedication live on through the success of your business.