Dream Big: Funding Opportunities for Foreign Spouses

Are you a foreign spouse dreaming of starting your own business in a new country? Are you feeling overwhelmed by the financial aspect of turning your business ideas into reality? Fear not, as there are plenty of funding opportunities available to help you kickstart your entrepreneurial journey.

Starting a business as a foreign spouse can be a challenging endeavor, especially when it comes to securing funding. However, with a little bit of research and determination, you can find the financial support you need to turn your dreams into reality. Here are some funding options that you can explore to get your business off the ground:

1. Small Business Administration (SBA) Loans: The Small Business Administration offers a variety of loan programs designed to help small businesses, including those owned by foreign spouses. These loans typically have lower interest rates and longer repayment terms than traditional bank loans, making them an attractive option for new entrepreneurs.

2. Minority Business Development Agency (MBDA) Grants: The MBDA offers grants to minority-owned businesses, including those owned by foreign spouses. These grants can provide the funding you need to launch or expand your business, without the burden of repayment.

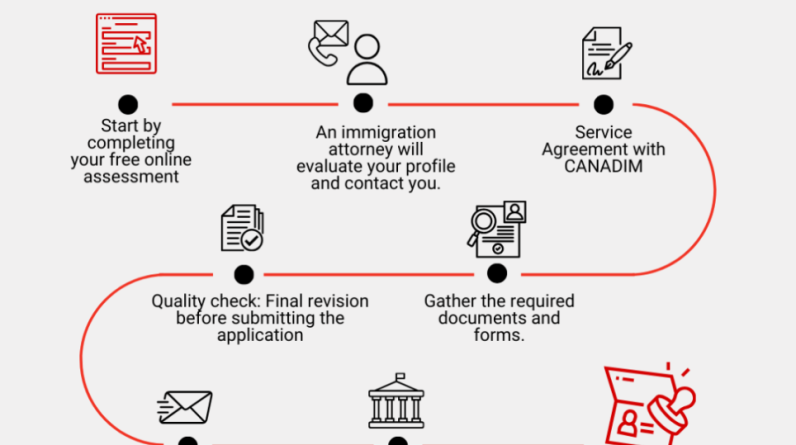

Image Source: canadim.com

3. Microloans: Microloans are small loans typically ranging from a few hundred to a few thousand dollars, designed to help entrepreneurs who may not qualify for traditional bank loans. Microloan programs are available through a variety of organizations, including non-profit lenders and community development financial institutions.

4. Crowdfunding: Crowdfunding platforms like Kickstarter and Indiegogo allow you to raise money for your business idea by soliciting small donations from a large number of people. This can be a great way to generate funding while also building a community around your brand.

5. Angel Investors: Angel investors are individuals who provide capital to start-up businesses in exchange for ownership equity or convertible debt. These investors can provide not only funding but also valuable expertise and connections to help your business succeed.

6. Venture Capital: Venture capital firms invest in high-growth potential companies in exchange for equity. While securing venture capital funding can be competitive, it can provide the substantial funding needed to scale your business quickly.

7. Government Grants: Many governments offer grants and incentives to encourage entrepreneurship and stimulate economic growth. These grants can provide a valuable source of funding for foreign spouses looking to start their own businesses.

Image Source: boundless.com

8. Incubators and Accelerators: Joining an incubator or accelerator program can provide you with funding, mentorship, and resources to help your business grow. These programs often culminate in a pitch event where you can showcase your business to potential investors.

9. Peer-to-Peer Lending: Peer-to-peer lending platforms connect borrowers with individual lenders willing to fund their projects. This can be a flexible and accessible funding option for foreign spouses looking to start a business.

10. Personal Savings and Assets: Don’t underestimate the power of your own savings and assets in funding your business. By investing your own money into your business, you demonstrate your commitment and dedication to its success.

Exploring funding options for foreign spouses to start a business may seem daunting at first, but with the right resources and support, you can turn your entrepreneurial dreams into reality. By thinking creatively and being open to different funding sources, you can secure the financial backing you need to launch and grow your business. So dream big, and take the first step towards building the business of your dreams.

From Idea to Reality: Financial Support for Business Startups

As a foreign spouse looking to start a business, finding the right financial support can make all the difference in turning your idea into a successful reality. There are various funding options available to help you get your business off the ground and thriving. From traditional bank loans to grants and crowdfunding, exploring all of your options can help you find the perfect fit for your entrepreneurial journey.

Image Source: boundless.com

One of the most common funding options for business startups is a traditional bank loan. Banks offer a variety of loan options, including small business loans, equipment loans, and lines of credit. These loans typically require a solid business plan, good credit history, and collateral. However, if you have a solid business idea and a well-thought-out plan, a bank loan can provide you with the capital you need to get your business up and running.

Another popular funding option for foreign spouses looking to start a business is grants. There are a variety of grants available specifically for minority-owned businesses, including those owned by foreign spouses. These grants do not need to be repaid, making them an attractive option for startup businesses. To qualify for a grant, you will typically need to submit a detailed business plan and demonstrate how your business will benefit the community or economy.

Crowdfunding is another innovative way to raise funds for your business startup. Websites like Kickstarter and Indiegogo allow you to create a campaign and pitch your business idea to a wide audience. People can then donate money to your campaign in exchange for rewards or equity in your business. Crowdfunding can be a great way to not only raise funds but also generate buzz and interest in your business before it even launches.

If you are a foreign spouse looking to start a business in the United States, you may also be eligible for the EB-5 Immigrant Investor Program. This program allows foreign investors to obtain a green card by investing in a commercial enterprise that creates jobs for American workers. By investing in your own business, you can not only secure funding but also obtain permanent residency in the United States.

In addition to these traditional funding options, there are also resources available specifically for foreign spouses looking to start a business. Organizations like SCORE and the Small Business Administration offer free resources and mentorship to help you navigate the startup process. These resources can provide valuable guidance and support as you launch your business and seek funding.

Ultimately, the key to turning your business idea into a successful reality is to explore all of your funding options and find the right fit for your unique situation. Whether you choose a bank loan, grant, crowdfunding, or another option, securing the funding you need can help you launch and grow your business with confidence. With determination and the right support, you can make your entrepreneurial dreams a reality as a foreign spouse starting a business.