Mastering the Art of Home Expenses Deductions!

When it comes to running a business, every penny counts. As a business owner, you are constantly looking for ways to save money and maximize your profits. One area that many business owners overlook is home expenses deductions. By understanding how to navigate home expenses as a business deduction on your K1, you can potentially save thousands of dollars in taxes each year.

The first step in mastering the art of home expenses deductions is to understand what expenses are deductible. The IRS allows business owners to deduct expenses that are both ordinary and necessary for their business. This includes expenses such as mortgage interest, property taxes, utilities, insurance, and repairs and maintenance. However, it’s important to note that personal expenses, such as groceries or personal phone bills, are not deductible.

When it comes to deducting home expenses on your K1, there are a few key things to keep in mind. First, you must use part of your home regularly and exclusively for business purposes in order to qualify for the deduction. This can be a specific room or area of your home that is used solely for conducting business. It’s important to keep detailed records and documentation of the business use of your home in case of an audit.

Another important factor to consider when deducting home expenses on your K1 is the method you use to calculate the deduction. There are two methods available to business owners: the simplified method and the regular method. The simplified method allows you to deduct $5 per square foot of the area used for business, up to a maximum of 300 square feet. The regular method involves calculating the actual expenses of your home office, such as mortgage interest, utilities, and repairs, and deducting a percentage of those expenses based on the size of your home office.

Image Source: immi-usa.com

To maximize your home expenses deduction on your K1, it’s important to keep accurate records of all expenses related to your home office. This includes keeping receipts and invoices for expenses such as utilities, repairs, and maintenance, as well as documenting the square footage of your home office and the total square footage of your home. By keeping detailed records, you can ensure that you are taking advantage of all eligible deductions and maximizing your tax savings.

In addition to deducting home expenses on your K1, there are other ways to save money on your taxes as a business owner. For example, you can deduct expenses for travel, meals, and entertainment related to your business, as well as expenses for office supplies, equipment, and software. It’s important to work with a tax professional to ensure that you are taking advantage of all available deductions and maximizing your tax savings.

In conclusion, mastering the art of home expenses deductions on your K1 can help you save money and maximize your profits as a business owner. By understanding what expenses are deductible, keeping detailed records, and using the appropriate calculation method, you can take advantage of all eligible deductions and save thousands of dollars in taxes each year. With a little knowledge and planning, you can navigate home expenses as a business deduction on your K1 with ease and confidence.

Simplifying Your Taxes with K1 Home Deductions!

When it comes to managing your finances as a business owner, every penny counts. One of the key areas where you can save money and maximize your tax deductions is by carefully navigating your home expenses as a business deduction on your K1 form. By understanding the ins and outs of this process, you can simplify your taxes and keep more money in your pocket.

First and foremost, it’s important to know what kinds of home expenses can be deducted on your K1 form. These can include mortgage interest, property taxes, utilities, home office expenses, and repairs and maintenance costs. By keeping track of these expenses throughout the year and properly documenting them, you can ensure that you are taking full advantage of all the deductions available to you.

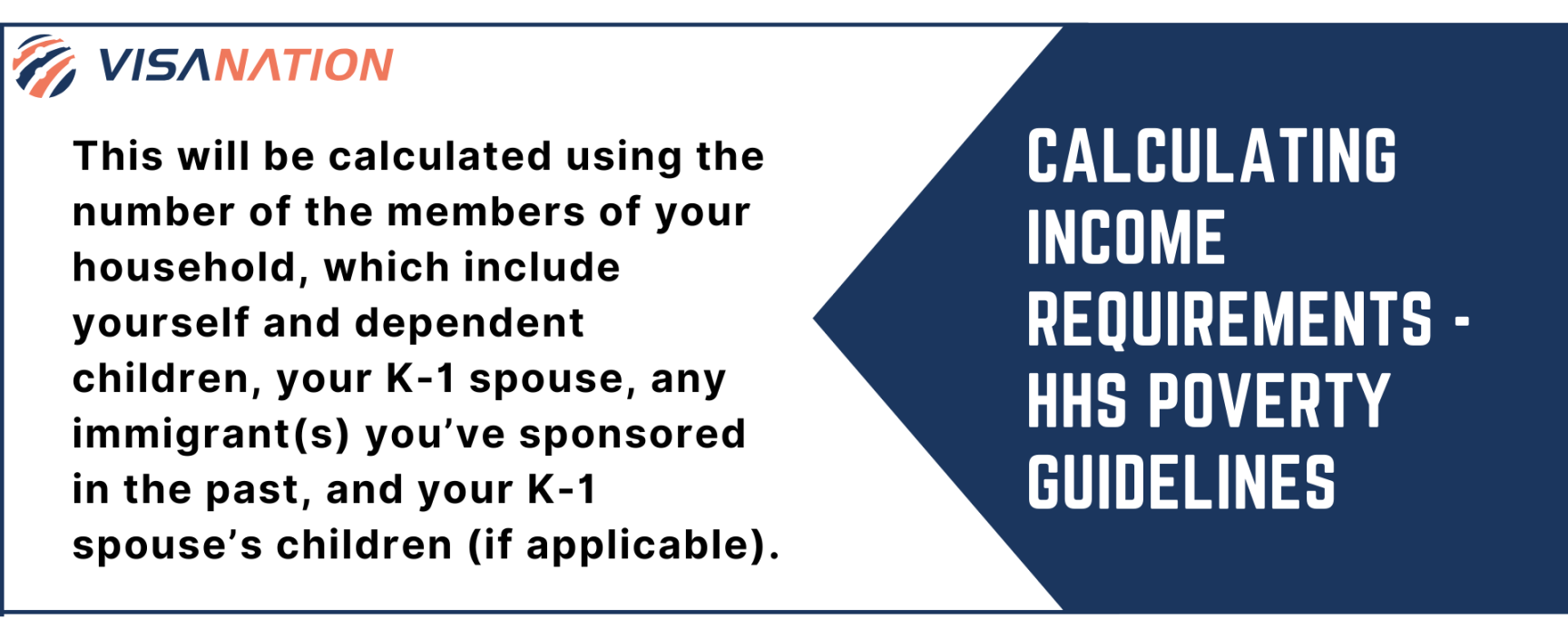

Image Source: investopedia.com

One of the most common home expenses that can be deducted on your K1 form is mortgage interest. If you use part of your home for business purposes, you can deduct the interest on that portion of your mortgage. This can result in significant savings, especially if you have a high mortgage balance or interest rate.

Property taxes are another deductible expense that can help lower your tax bill. By including your property taxes on your K1 form, you can offset some of the costs associated with owning a home and running a business. Be sure to keep copies of your property tax statements and any receipts for payments made throughout the year.

Utilities, such as electricity, water, and gas, can also be deducted on your K1 form if they are used for business purposes. If you have a home office or use part of your home for work-related activities, you can allocate a percentage of your utility costs as a business expense. This can add up to significant savings over time and make a difference in your overall tax liability.

Home office expenses are another area where you can save money by deducting them on your K1 form. This can include expenses such as office supplies, furniture, equipment, and even a portion of your internet and phone bills. By properly documenting these expenses and calculating the percentage that is used for business purposes, you can ensure that you are maximizing your deductions and reducing your tax burden.

Repairs and maintenance costs for your home can also be deducted on your K1 form if they are necessary for your business operations. This can include things like fixing a leaky roof, painting the exterior of your home, or repairing a broken appliance. By keeping track of these expenses and documenting them properly, you can ensure that you are not missing out on any potential deductions.

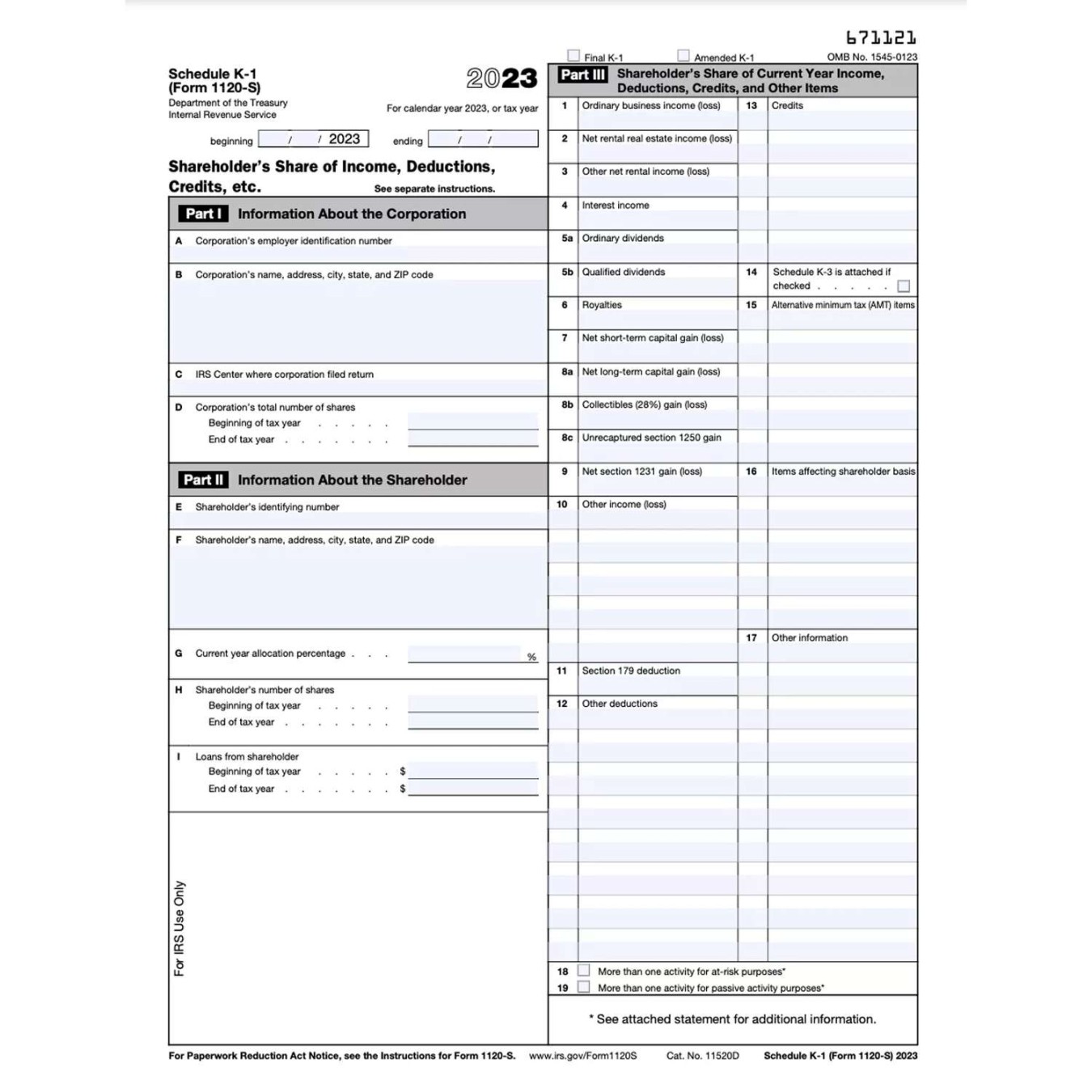

Image Source: qbkaccounting.com

In conclusion, navigating your home expenses as a business deduction on your K1 form can be a complex process, but with careful planning and organization, you can simplify your taxes and save money. By understanding which expenses are deductible and keeping thorough records throughout the year, you can ensure that you are taking full advantage of all the tax benefits available to you as a business owner. So don’t wait, start organizing your home expenses today and reap the benefits come tax time!