Mastering the Art of Cash Flow: Your ATM Business Guide

Welcome to the exciting world of ATM business ownership! Whether you are a seasoned entrepreneur or a newcomer to the business world, operating an ATM business can be a lucrative venture. However, like any business, mastering the art of cash flow is essential to your success. In this guide, we will explore key strategies to help you unlock cash flow and finance your ATM business effectively.

First and foremost, it is important to understand the basics of cash flow in the ATM business. Cash flow refers to the movement of money in and out of your business, including revenue from ATM transactions, operating expenses, and profits. To effectively manage cash flow, you must have a clear understanding of your income and expenses, as well as a solid plan for financing your operations.

One of the first steps in mastering cash flow for your ATM business is to establish a solid business plan. Your business plan should outline your goals, target market, competitive analysis, and financial projections. By having a clear roadmap for your business, you can better plan for expenses, manage cash flow, and secure financing when needed.

In addition to a solid business plan, it is essential to establish a reliable cash management system for your ATM business. This includes monitoring cash levels in your ATMs, reconciling transactions, and managing operating expenses. By implementing a robust cash management system, you can optimize cash flow, reduce the risk of theft or fraud, and improve overall financial performance.

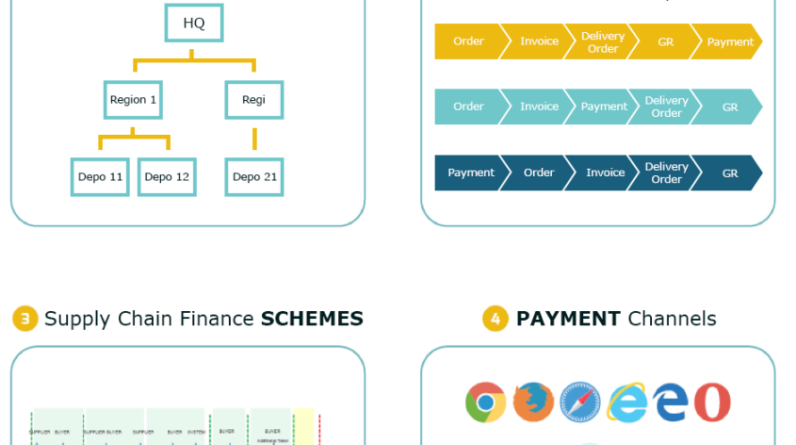

Image Source: sgo.co.id

Another key strategy for mastering cash flow in your ATM business is to diversify your revenue streams. In addition to generating income from ATM transactions, consider offering additional services such as advertising, surcharge fees, or value-added services to boost revenue. By diversifying your revenue streams, you can increase cash flow, improve profitability, and grow your business over time.

When it comes to financing your ATM business, there are several options available to help you unlock cash flow and achieve your goals. One common financing option for ATM operators is equipment financing, which allows you to purchase or lease ATMs without tying up your capital. By financing your equipment, you can conserve cash flow, preserve working capital, and expand your ATM network more quickly.

In addition to equipment financing, you may also consider securing a business line of credit to finance your ATM operations. A business line of credit provides you with a flexible source of capital that you can use to cover operating expenses, purchase inventory, or fund marketing initiatives. By having access to a business line of credit, you can better manage cash flow fluctuations and take advantage of growth opportunities as they arise.

Another financing option to consider for your ATM business is a small business loan. Small business loans can provide you with the capital you need to purchase additional ATMs, expand your business, or invest in marketing initiatives. By securing a small business loan, you can access the funds you need to grow your ATM business and achieve your financial goals.

In conclusion, mastering the art of cash flow is essential to the success of your ATM business. By establishing a solid business plan, implementing a reliable cash management system, diversifying your revenue streams, and exploring financing options, you can unlock cash flow, finance your operations effectively, and achieve your business goals. With the right strategies and mindset, you can build a successful and profitable ATM business that generates steady cash flow for years to come.

Financing Made Easy: Tips for Boosting Your ATM Revenue

Image Source: media-amazon.com

Are you looking to boost your ATM revenue but not sure where to start? Financing your ATM business can be a great way to increase cash flow and grow your business. With the right tips and strategies, you can easily unlock the potential for increased revenue and success.

One of the first steps in financing your ATM business is to explore different financing options. There are a variety of ways to secure funding for your ATM business, including traditional bank loans, lines of credit, and alternative financing options. By researching and comparing different financing options, you can choose the one that best fits your business needs and goals.

Another key tip for boosting your ATM revenue is to consider expanding your ATM network. By adding more ATMs to your business, you can increase your revenue potential and reach a larger customer base. Look for high-traffic locations with a demand for ATM services to maximize your revenue potential.

In addition to expanding your ATM network, you can also increase your revenue by offering additional services at your ATMs. Consider adding features such as mobile top-up, bill payment, and money transfer services to attract more customers and generate additional revenue streams. By providing convenient and valuable services, you can increase customer loyalty and drive more transactions at your ATMs.

One creative way to boost your ATM revenue is to partner with local businesses to place ATMs in their locations. By forming partnerships with businesses such as convenience stores, gas stations, and retail shops, you can expand your ATM network and reach new customers. In exchange for hosting your ATM, you can offer revenue-sharing agreements to incentivize businesses to work with you.

Image Source: ytimg.com

Another tip for boosting your ATM revenue is to optimize your ATM placements for maximum visibility and convenience. Choose high-traffic locations with limited ATM competition to attract more customers and drive higher transaction volumes. Consider placing ATMs near popular shopping areas, tourist attractions, and transportation hubs to increase foot traffic and revenue.

To increase your ATM revenue, it’s important to regularly monitor and analyze your ATM performance. Keep track of your transaction volumes, surcharge revenue, and operational costs to identify opportunities for improvement. By analyzing your data and making data-driven decisions, you can optimize your ATM network for maximum profitability and success.

In conclusion, financing your ATM business can be a great way to boost your revenue and grow your business. By exploring different financing options, expanding your ATM network, offering additional services, forming partnerships with local businesses, optimizing your ATM placements, and analyzing your performance, you can unlock the potential for increased cash flow and success. With the right tips and strategies, you can take your ATM business to the next level and achieve your financial goals.