Unleash the Power of Business Losses!

Are you a business owner who has experienced some setbacks this year? Don’t fret – there may be a silver lining to your financial woes. By understanding how to navigate business losses for a tax refund, you can potentially maximize your refund and turn those setbacks into a valuable opportunity for financial gain.

Business losses are a common occurrence in the world of entrepreneurship. Whether it’s due to unexpected expenses, a drop in sales, or a failed business venture, experiencing a loss can be disheartening. However, it’s important to remember that these losses can actually work in your favor when it comes to tax time.

One of the key benefits of business losses is the opportunity to deduct these losses from your overall income, potentially reducing your taxable income and increasing your chances of receiving a larger tax refund. By properly documenting and reporting your business losses, you can ensure that you are taking full advantage of this tax benefit.

To unleash the power of business losses, it’s important to keep detailed records of all financial transactions related to your business. This includes tracking expenses, sales, investments, and any other financial activities that may impact your bottom line. By maintaining accurate records, you can provide the necessary documentation to support your claim for business losses when filing your taxes.

Image Source: ytimg.com

In addition to keeping detailed records, it’s also important to understand the tax laws and regulations surrounding business losses. Different rules may apply depending on the type of business entity you operate, so it’s important to consult with a tax professional to ensure that you are following the correct procedures and maximizing your potential for a tax refund.

Another way to unleash the power of business losses is to consider carrying forward any unused losses to future tax years. This can help offset future income and reduce your tax liability in the long run. By strategically planning for the utilization of business losses, you can create a more favorable financial outlook for your business moving forward.

In summary, experiencing business losses doesn’t have to be a negative experience. By understanding how to navigate business losses for a tax refund, you can turn those setbacks into a valuable opportunity for financial gain. By keeping detailed records, understanding tax laws, and strategically planning for the utilization of business losses, you can unleash the power of business losses and maximize your potential for a larger tax refund. So don’t let setbacks discourage you – embrace the power of business losses and watch your financial outlook improve!

Turn Setbacks into Tax Refunds!

Are you a small business owner who has experienced setbacks or losses in the past year? Don’t worry, there is a silver lining to those dark clouds – you can actually turn those setbacks into tax refunds! By strategically navigating your business losses, you can maximize your refund and put some extra money back into your pocket. In this article, we will explore how you can make the most out of your business losses and come out ahead during tax season.

One of the key ways to turn setbacks into tax refunds is by carefully documenting and calculating your losses. Keep track of all expenses related to the setbacks, including repairs, replacements, and any other costs incurred as a result. By having a clear record of these losses, you can accurately report them on your tax return and potentially qualify for a deduction or credit.

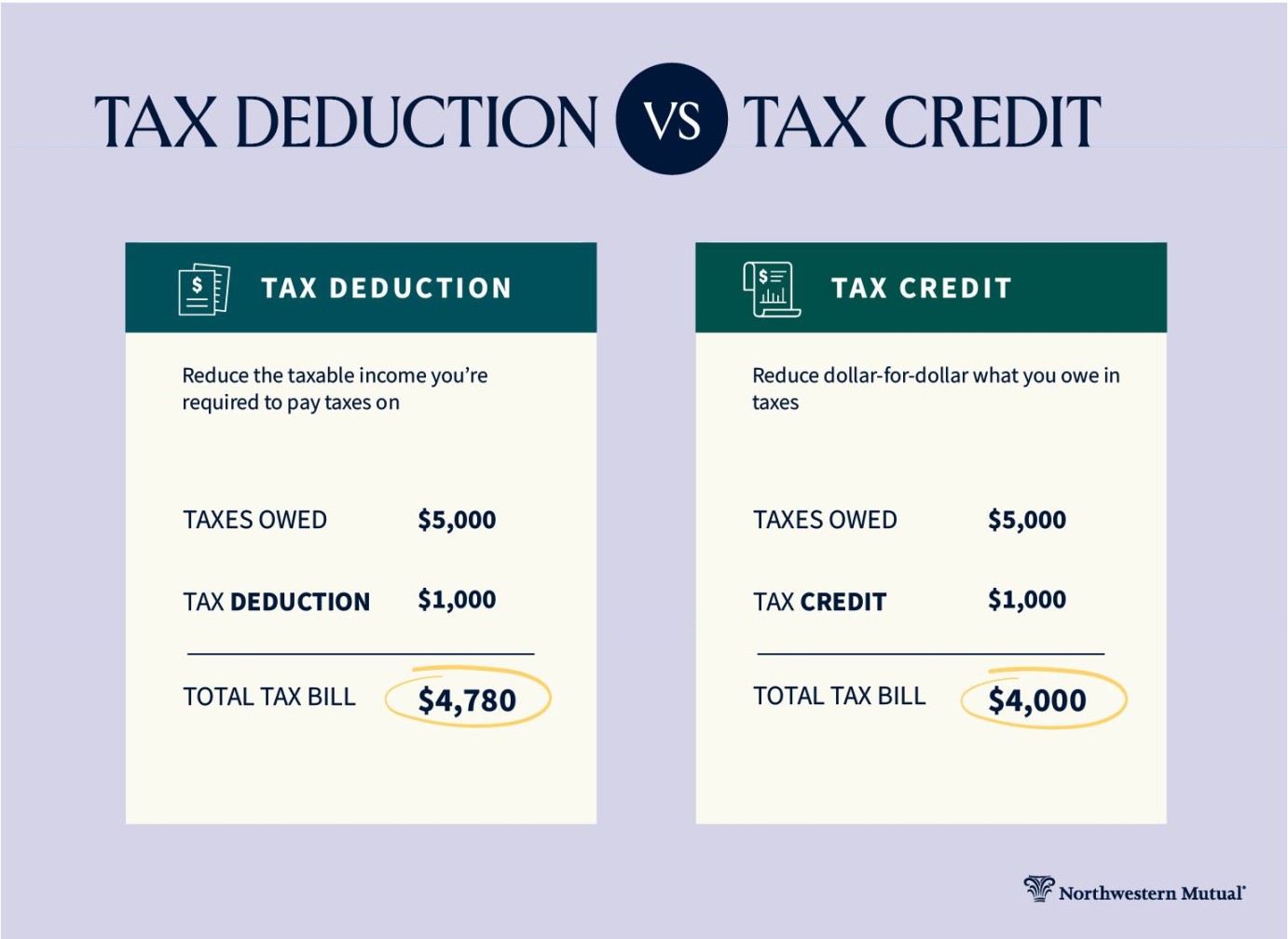

Image Source: northwesternmutual.com

Additionally, it’s important to understand the different ways in which you can claim business losses on your tax return. Depending on your business structure, you may be able to deduct losses on your personal tax return, carry them forward to future years, or even offset them against other income. By familiarizing yourself with the various options available to you, you can choose the most advantageous strategy for maximizing your refund.

Another important factor to consider when navigating business losses for a tax refund is seeking professional advice. A tax accountant or financial advisor can help you navigate the complexities of tax law and ensure that you are taking full advantage of any available deductions or credits. They can also help you develop a tax strategy that minimizes your liability and maximizes your refund.

In addition to seeking professional advice, it’s also a good idea to stay informed about changes to the tax code that may impact how you can claim business losses. Tax laws are constantly evolving, so keeping up-to-date with the latest regulations and requirements can help you make informed decisions about your taxes and ensure that you are maximizing your refund.

Finally, don’t forget to keep a positive attitude when navigating business losses for a tax refund. While setbacks can be frustrating and challenging, they also present an opportunity for growth and learning. By approaching tax season with a proactive and optimistic mindset, you can turn those setbacks into valuable lessons and ultimately come out ahead.

In conclusion, turning setbacks into tax refunds is a skill that every small business owner should master. By carefully documenting and calculating your losses, understanding your options for claiming business losses, seeking professional advice, staying informed about tax law changes, and maintaining a positive attitude, you can maximize your refund and make the most out of a challenging situation. So don’t let setbacks hold you back – instead, embrace them as an opportunity to boost your bottom line and secure a brighter financial future.

Image Source: website-files.com