Unlocking the Mystery: Business Credit Score of 58

Is a Business Credit Score of 58 Good for Your Company? That’s the question on many business owner’s minds when they receive their credit score report. It can be a bit of a mystery trying to decipher what exactly a credit score of 58 means for your company. But fear not, we’re here to unlock the mystery and shed some light on the topic.

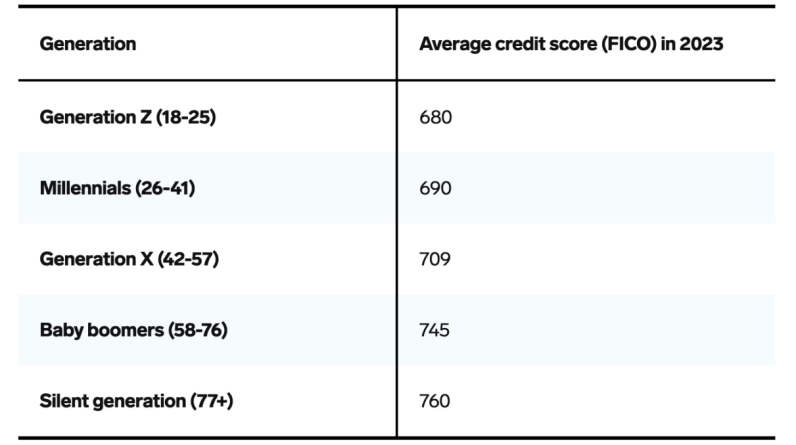

A business credit score is a numerical representation of a company’s creditworthiness. It ranges from 0 to 100, with higher scores indicating a better credit profile. A score of 58 falls in the middle of the spectrum, which may leave some business owners feeling uncertain about their financial standing.

However, a credit score of 58 is not necessarily a cause for concern. In fact, it can be seen as a stepping stone towards building a stronger credit profile for your company. This score suggests that your company has been using credit responsibly, but there is room for improvement.

One of the advantages of having a credit score of 58 is that it shows lenders and suppliers that your company is actively using credit and making payments on time. This can help establish a positive credit history and open doors to future financing opportunities.

Image Source: substackcdn.com

Another benefit of a credit score of 58 is that it allows you to identify areas for improvement. By reviewing your credit report, you can pinpoint any negative factors that may be affecting your score and take steps to address them. This proactive approach can help increase your credit score over time.

Additionally, a credit score of 58 can serve as a motivation for your company to strive for better financial habits. By setting goals to improve your credit score, you can implement strategies such as paying bills on time, reducing debt, and monitoring your credit report regularly.

It’s important to remember that a credit score is just one piece of the financial puzzle for your company. While a score of 58 may not be perfect, it doesn’t define the success or potential of your business. With dedication and a positive attitude, you can work towards building a stronger credit profile and achieving your financial goals.

In conclusion, a credit score of 58 may not be ideal, but it is certainly not a cause for alarm. By viewing it as an opportunity for growth and improvement, you can use this score as a tool to enhance your company’s financial health. So embrace the mystery of your credit score and take the necessary steps to unlock its full potential.

The Power of Positivity: Why 58 is Great for Your Company

Is a business credit score of 58 good for your company? The answer may surprise you. While some may see a score of 58 as mediocre or average, there are actually many reasons why a score of 58 can be great for your company. In this article, we will explore the power of positivity and how a score of 58 can actually benefit your business in more ways than you may think.

Image Source: capitalone.com

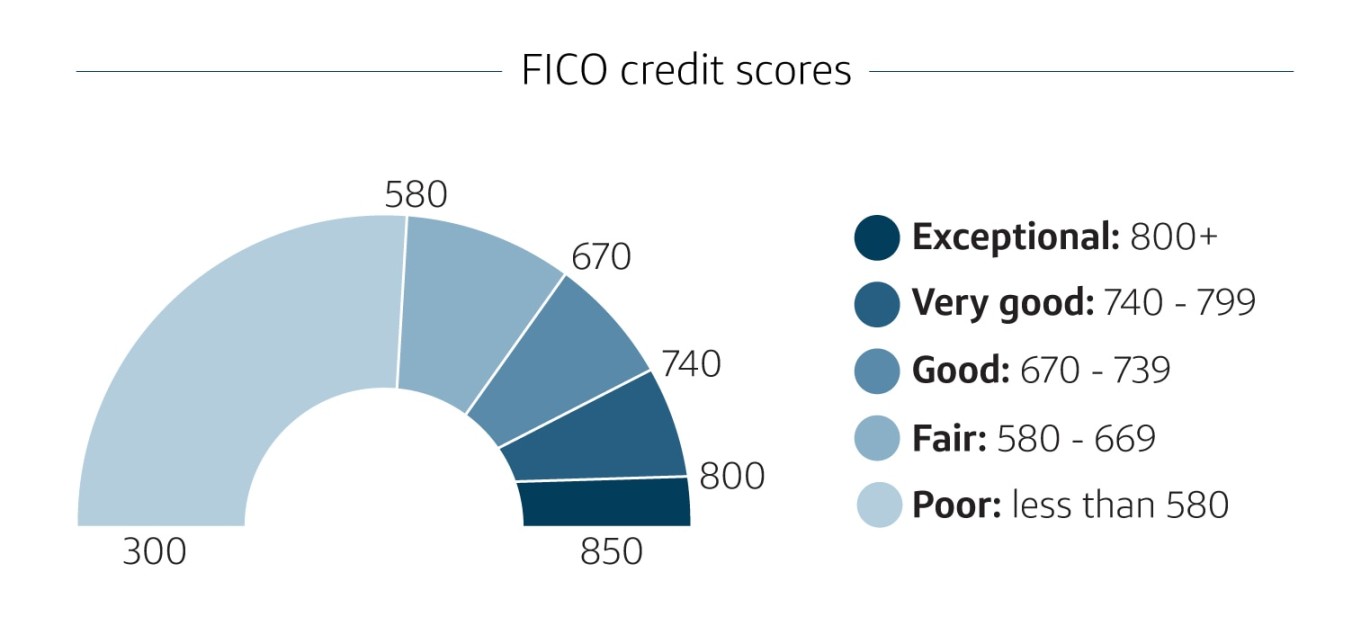

First and foremost, a business credit score of 58 indicates that your company is in good standing with creditors. This means that you have a history of making timely payments and managing your debts responsibly. This can give lenders and suppliers confidence in your ability to meet your financial obligations, which can open up more opportunities for your business. With a score of 58, you may be able to access better financing options, negotiate lower interest rates, and secure larger lines of credit.

Additionally, a business credit score of 58 shows that your company is on the right track towards improvement. While a score of 58 may not be perfect, it is a solid foundation to build upon. By continuing to make timely payments, reducing your debt-to-credit ratio, and monitoring your credit report for errors, you can gradually increase your score over time. This demonstrates to creditors and investors that your company is committed to financial responsibility and growth.

Furthermore, a score of 58 can help your company stand out from competitors. In today’s competitive business landscape, having a strong credit score can give you a competitive edge. Potential partners, investors, and customers may view your company more favorably if they see that you have a respectable credit score. This can help you attract new business opportunities and establish yourself as a trustworthy and reliable company.

Moreover, a score of 58 can also be a source of motivation for your company. Instead of viewing a score of 58 as a setback, see it as an opportunity for improvement. Use your score as a benchmark to set goals and track your progress towards achieving a higher score. Celebrate small victories along the way, such as paying off a debt or increasing your credit limit. By maintaining a positive attitude and staying proactive about managing your credit, you can continue to elevate your company’s financial health.

In conclusion, a business credit score of 58 can be a great asset for your company. It demonstrates financial responsibility, shows potential for improvement, sets you apart from competitors, and serves as a source of motivation. So, instead of dwelling on the number itself, focus on the positive aspects of having a score of 58 and use it as a tool to propel your company forward. Remember, with the power of positivity and determination, your company can achieve great success, no matter what your credit score may be.