Setting Your Business Up for Success

When it comes to securing a business loan, there are several essential documents that you will need to have in order to increase your chances of approval. Setting your business up for success means being prepared and organized, so that lenders can see that you are a reliable and responsible borrower. In this article, we will discuss the key documents that you will need to gather in order to secure a business loan.

One of the first documents that you will need to have in place is a solid business plan. This plan should outline your business goals, target market, competition, and financial projections. Lenders want to see that you have a clear vision for your business and that you have a plan in place for how you will use the loan funds to grow and expand your operations.

In addition to a business plan, you will also need to provide financial statements for your business. This includes a balance sheet, income statement, and cash flow statement. These documents will show lenders that your business is financially stable and capable of repaying the loan. You may also be required to provide tax returns for your business, as well as personal tax returns for any owners or partners.

Another important document that lenders will look for is a detailed list of your business assets. This includes any equipment, inventory, real estate, or intellectual property that your business owns. Lenders want to see that you have valuable assets that can be used as collateral for the loan, in case you are unable to repay it.

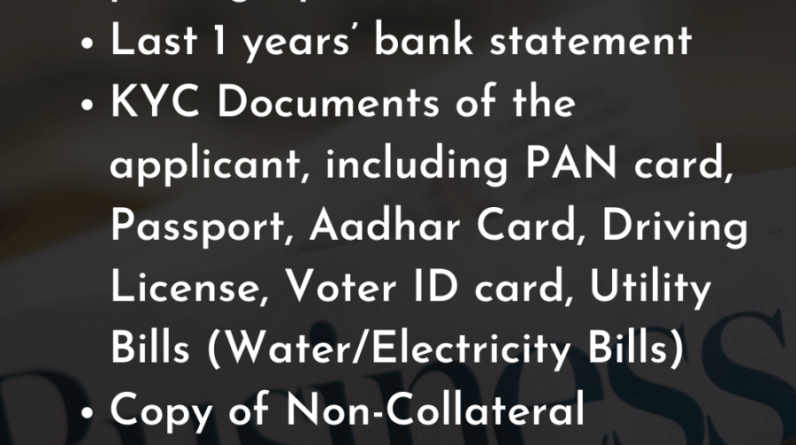

Image Source: gstguntur.com

In addition to these financial documents, lenders will also want to see proof of your business’s legal status. This includes documents such as your business license, Articles of Incorporation, and any relevant permits or certifications. Lenders want to ensure that your business is operating legally and that there are no outstanding legal issues that could impact your ability to repay the loan.

Finally, you will need to provide a personal guarantee for the loan. This means that you are personally responsible for repaying the loan if your business is unable to do so. Lenders want to see that you are willing to take on the risk of borrowing money for your business, and that you have a personal stake in its success.

By gathering all of these key documents and setting your business up for success, you will increase your chances of securing a business loan. Lenders want to see that you are a responsible and reliable borrower, and having all of the necessary documents in place will show them that you are serious about growing your business. So take the time to gather all of the required documents, and start the process of securing the funding that your business needs to succeed.

Gathering the Key Documents

When it comes to securing a business loan, one of the most important steps you can take is gathering all of the key documents that lenders will require. These documents are essential in proving to lenders that you are a credible and trustworthy borrower, and that your business is a solid investment. In this article, we will explore the key documents that you will need to gather in order to secure a business loan.

1. Business Plan

Image Source: website-files.com

One of the first documents that lenders will ask for is a comprehensive business plan. Your business plan should outline your business goals, objectives, financial projections, and how you plan to achieve success. This document is crucial in demonstrating to lenders that you have a clear vision for your business and a strategic plan for growth. Make sure to include details on your target market, competition, and marketing strategies in your business plan.

2. Financial Statements

Lenders will also require you to provide detailed financial statements for your business. This includes balance sheets, income statements, and cash flow statements. These statements provide lenders with a clear picture of your business’s financial health and viability. Make sure your financial statements are up-to-date and accurate, as lenders will use this information to assess your ability to repay the loan.

3. Personal and Business Tax Returns

In addition to your business financial statements, lenders will also ask for personal and business tax returns. This helps lenders verify your income and assess your tax compliance. Make sure to have several years of tax returns on hand, as lenders may ask for this information to evaluate your financial history.

![How to Qualify for a Business Loan [Required Documents & More] How to Qualify for a Business Loan [Required Documents & More]](https://www.novaflarevibe.biz.id/wp-content/uploads/2025/03/how-to-qualify-for-a-business-loan-required-documents-amp-more.jpg)

Image Source: nbcbanking.com

4. Legal Documents

Lenders will also require you to provide various legal documents, including business licenses, registrations, and permits. These documents prove that your business is operating legally and in compliance with regulations. Additionally, lenders may ask for documents such as articles of incorporation, partnership agreements, and contracts to verify your business’s legal structure and ownership.

5. Personal and Business Credit Reports

Another key document that lenders will review is your personal and business credit reports. Your credit score plays a significant role in determining your eligibility for a business loan, as it reflects your creditworthiness and ability to repay debts. Make sure to review your credit reports and address any errors or discrepancies before applying for a loan.

6. Collateral Documentation

Depending on the type of loan you are applying for, lenders may ask for collateral documentation. This could include property deeds, vehicle titles, or other assets that you are willing to pledge as collateral for the loan. Collateral provides lenders with additional security and assurance that they will recoup their investment in case of default.

7. Personal Identification

Lastly, lenders will need to verify your identity by requesting personal identification documents, such as a driver’s license or passport. This helps lenders confirm your identity and prevent fraud in the loan application process.

In conclusion, gathering the key documents for a business loan is a crucial step in securing financing for your business. By preparing and organizing all of the necessary documents, you can demonstrate to lenders that you are a credible and trustworthy borrower. Make sure to have all of the required documents ready before applying for a loan to streamline the application process and increase your chances of approval.