Understanding the Allocation of Business Loan Interest on Form 1065

When it comes to navigating the ins and outs of business finances, one area that often leaves business owners scratching their heads is the allocation of business loan interest on Form 1065. This seemingly complex task can be simplified by cracking the code and diving into the details of interest splitting on this important tax form.

Crack the Code: Business Loan Interest Allocation

Business loan interest allocation can be a tricky concept to grasp, but with a little know-how, you can crack the code and understand how it all works. When a partnership takes out a business loan, the interest that accrues on that loan must be allocated among the partners in a way that is fair and accurate.

The first step in cracking the code of business loan interest allocation is to determine the total amount of interest that has accrued on the loan. This can be done by reviewing the loan documents or speaking with the lender to get the most up-to-date information.

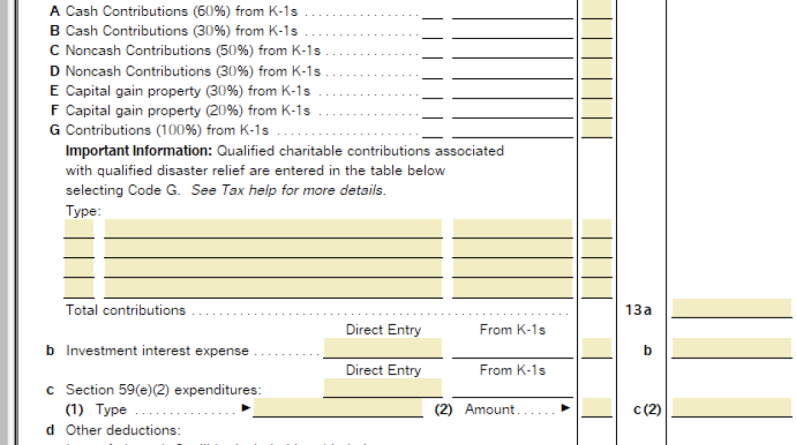

Image Source: intuit.com

Once you have the total amount of interest, the next step is to allocate that interest among the partners in the partnership. This is typically done based on each partner’s share of the partnership’s profits and losses. For example, if one partner owns 50% of the partnership, they would be allocated 50% of the business loan interest.

It’s important to remember that the allocation of business loan interest must be done in a way that is consistent with the partnership agreement and in accordance with IRS guidelines. Taking the time to crack the code of business loan interest allocation will ensure that your Form 1065 is accurate and compliant.

Dive into the Details of Form 1065 Interest Splitting

Form 1065 is the tax form that partnerships use to report their income, deductions, and credits to the IRS. When it comes to interest splitting on Form 1065, diving into the details is essential to ensure that the allocation is done correctly.

One of the key details to consider when splitting interest on Form 1065 is whether the loan proceeds were used for business purposes. If the loan was used solely for business expenses, then the interest is typically deductible as a business expense on the partnership’s tax return.

Another important detail to consider is whether the loan was taken out by the partnership as a whole or by individual partners. If the loan was taken out by individual partners, the interest may need to be allocated differently than if the loan was taken out by the partnership.

When diving into the details of Form 1065 interest splitting, it’s important to keep accurate records of all loan documents, interest payments, and allocations. This will make it easier to complete the form accurately and avoid any potential issues with the IRS.

In conclusion, understanding the allocation of business loan interest on Form 1065 is a crucial aspect of managing a partnership’s finances. By cracking the code and diving into the details of interest splitting, business owners can ensure that their tax filings are accurate and compliant. So, roll up your sleeves, grab your calculators, and get ready to tackle the world of business loan interest allocation with confidence!

Dive into the Details of Form 1065 Interest Splitting

When it comes to understanding the allocation of business loan interest on Form 1065, it’s important to dive deep into the details to ensure accuracy and compliance. Form 1065, also known as the U.S. Return of Partnership Income, is a key document for partnerships to report their income, deductions, credits, and more. One important aspect of Form 1065 is the allocation of business loan interest, which can have a significant impact on the partnership’s tax liability.

Business loan interest can be a substantial expense for many partnerships, and it’s crucial to properly allocate this interest on Form 1065. The IRS requires partnerships to allocate business loan interest based on the partnership agreement or in accordance with the partners’ ownership percentages. This ensures that each partner’s share of the interest expense is accurately reflected on the tax return.

Partnerships must carefully review their partnership agreement to determine the proper allocation of business loan interest. The agreement should outline how business expenses, including interest, should be divided among the partners. In some cases, partners may agree to allocate interest based on their capital contributions to the partnership, while in other cases, interest may be allocated based on the partners’ ownership percentages.

It’s important for partnerships to follow the guidelines outlined in their partnership agreement when allocating business loan interest on Form 1065. Failure to do so could result in inaccuracies on the tax return and potential penalties from the IRS. By taking the time to carefully review the partnership agreement and allocate interest correctly, partnerships can ensure compliance and avoid costly mistakes.

In addition to the partnership agreement, partnerships must also consider the IRS guidelines for allocating business loan interest on Form 1065. The IRS provides specific rules for allocating interest expense, which partnerships must adhere to when preparing their tax return. These rules help ensure that interest is allocated fairly and accurately among the partners.

Partnerships must also consider any special allocations or exceptions that may apply to their specific situation. For example, partnerships with debt-financed distributions or complex ownership structures may need to make special allocations of interest to comply with IRS regulations. By understanding these special rules and exceptions, partnerships can ensure that their allocation of business loan interest on Form 1065 is correct.

When allocating business loan interest on Form 1065, partnerships must also consider any limitations on the deduction of interest expense. The IRS has specific rules regarding the deductibility of business interest, including limitations based on the partnership’s adjusted taxable income. Partnerships must carefully calculate their deductible interest expense and ensure that it is accurately reported on Form 1065.

In conclusion, understanding the allocation of business loan interest on Form 1065 is essential for partnerships to accurately report their income and deductions. By carefully reviewing their partnership agreement, following IRS guidelines, and considering any special rules or limitations, partnerships can ensure that their allocation of business loan interest is correct and in compliance with tax regulations. Taking the time to dive into the details of Form 1065 interest splitting can help partnerships avoid costly mistakes and penalties, while maximizing their tax deductions.